Whistleblowers Can Defeat Medicare Advantage Fraud

Twenty-eight million Americans now rely on “Medicare Advantage” (MA) plans, also known as “Part C” for their health insurance benefits. These plans have a special structure, which can improve service and provide savings, but unfortunately also provide new ways for companies to cheat the government.

MA plans offer the same “traditional” Medicare benefits to beneficiaries in exchange for “capitated” payments from the government. That means the plans receive a set amount each month from the government for each beneficiary they cover, regardless of the healthcare services provided to the beneficiary. To entice beneficiaries, the plans frequently offer additional benefits, and the capitated payment model also theoretically saves the government money.

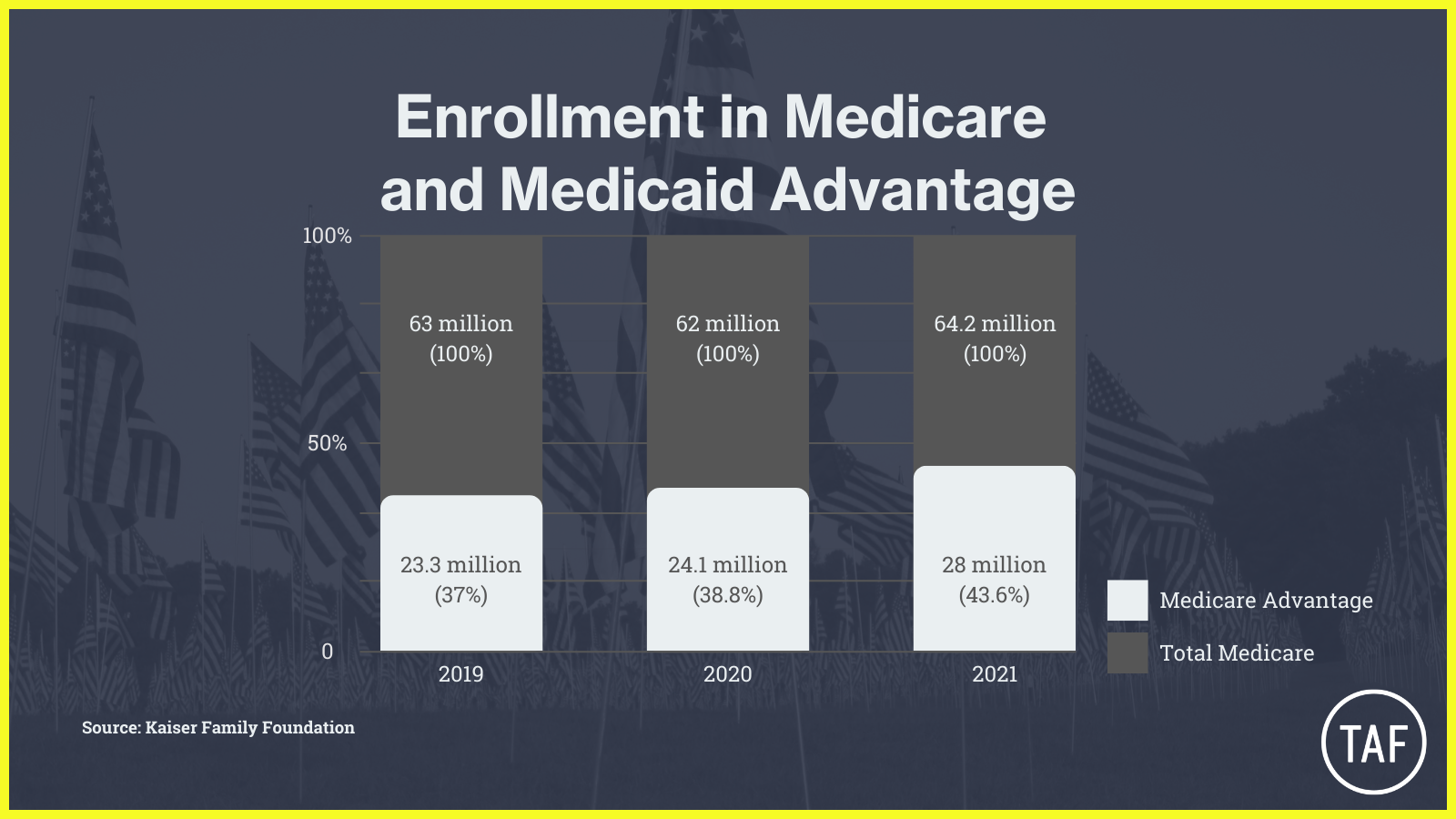

The siren call of all these advantages has led to steady growth in enrollment, a 20% increase between 2019 to 2021 in beneficiaries.

A full 45% of Medicare beneficiaries are now enrolled in these plans. As you can see from the chart above, both the raw number of Americans enrolled in Medicare Advantage Plans and the percentage of total Medicare beneficiaries are steadily rising. Kaiser Family Foundation reports that more than half of all Medicare beneficiaries will be enrolled in Medicare Advantage plans by 2030.

The government pays MA plans more to cover sicker patients, on the assumption that they need more healthcare and therefore cost more to cover. The government determines how sick patients are, and how much to pay insurers, based on diagnosis data provided by healthcare providers. If the insurers show they have “sicker” patients, they get more money, because supposedly their beneficiaries are receiving more treatment.

But multiple whistleblower cases and repeated government audits show that Medicare Advantage providers have cheated the system by finding ways to generate diagnoses for which their patients are not actually being treated and even submitting diagnoses that they know the patients don’t have.

With so many millions of Americans dependent on the program now, the impact of Medicare Advantage fraud has become monstrous. According to a November 2021 analysis of Medicare Advantage billing data, the government is estimated to have “overpaid [Medicare Advantage] plans by more than $106 billion from 2010 through 2019,” with almost $34 billion originating in 2018-2019. Recouping and stopping those overpayments would get us a long way towards expanding Medicare coverage by lowering the age of eligibility or recognizing that “Seniors Have Eyes, Ears, and Teeth.”

Meanwhile, big name health insurers, particularly those with high Medicare Advantage enrollment, are raking in record profits and concerns about these plans not providing necessary care are growing.

Whistleblowers, such as medical coders, providers, and employees of Medicare Advantage plans, have already had some success in reporting fraud. Two recent cases, related to just this kind of Medicare Advantage fraud, recouped more than $96 million combined.

Since Medicare Advantage will continue to grow, there will be more monsters, and more need for whistleblowers to slay them.

Written by Renée Brooker and Eva Gunasekera of Tycko & Zavareei LLP.Edited by James King of Taxpayers Against Fraud. Fact checked by Julia-Jeane Lighten of Taxpayers Against Fraud.