Housing Market May Be Cooling but Mortgage Fraud is Still a Hot Issue

In November 2009, the Financial Fraud Enforcement Task Force (“FFETF”) was established to address a financial crisis to which mortgage fraud contributed. The following year, FFETF, together with DOJ and the FBI, announced its first enforcement action: Operation Stolen Dreams.

This enforcement action was an “aggressive, coordinated and proactive effort” to target financial fraud, prosecute wrongdoers, obtain civil settlements, and resulted in the arrest of mortgage fraudsters responsible for over $2.3 billion in losses. Operation Stolen Dreams was an inflection point, and from the early 2010s onward, whistleblowers have played a more crucial role in government efforts to combat mortgage fraud.

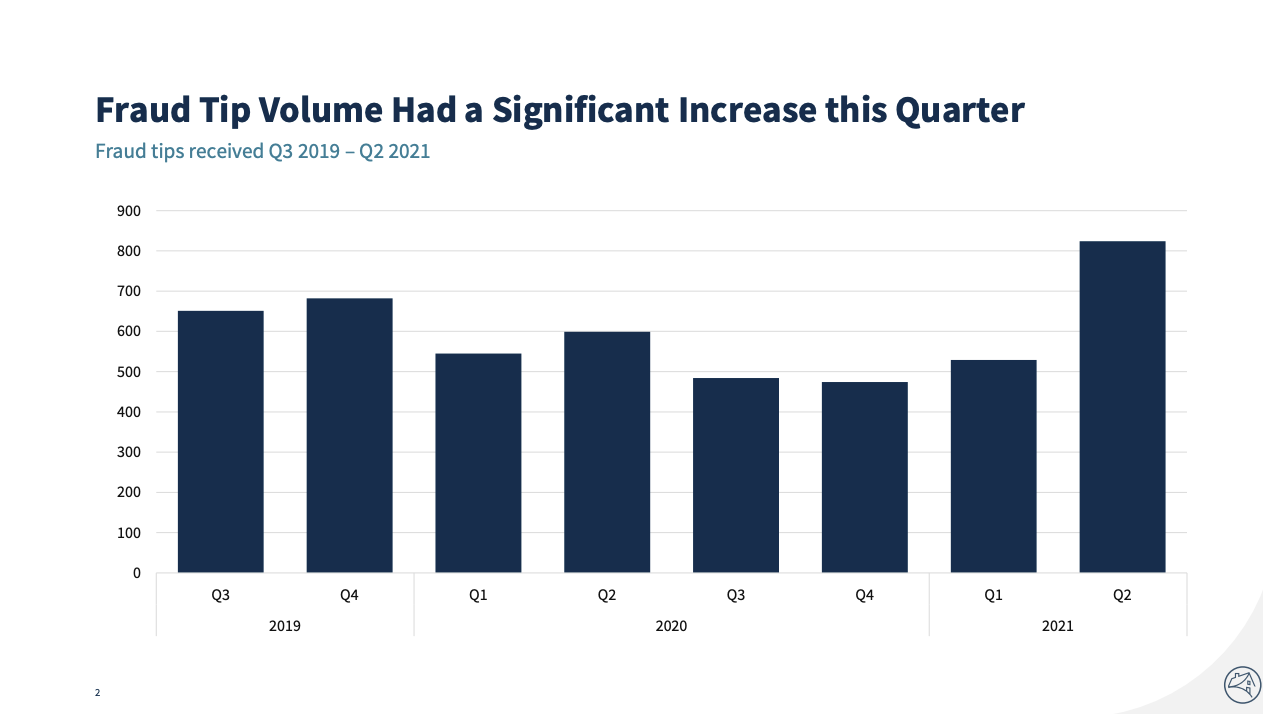

So, how prevalent is mortgage fraud? According to CoreLogic’s 2021 Annual Mortgage Fraud Report, the estimated number of mortgage applications that showed indications of fraud in Q2 2021 was 0.83%, or about 1 in 120 applications. This represents a 36% increase from the estimated 0.61%, or about 1 in 164 applications, that showed indications of fraud in Q2 2020. The sectors that showed the highest risk for fraudulent misconduct were investment properties (about 1 in 23 applications), with a 37.2% increase in overall fraud risk from Q1 2020 – Q2 2021.

However, False Claims Act liability only applies to a subset of these mortgages–namely, loans made by Federal Housing Administration (FHA)-approved lenders. When borrowers default on these loans, FHA funds are deployed. Multiple False Claims Act qui tam actions have alleged fraud on these loans.

Written by Julia-Jeane Lighten and Alex Cala of Taxpayers Against Fraud. Edited by Jeb White of Taxpayers Against Fraud. Fact checked by Julia-Jeane Lighten of Taxpayers Against Fraud.