Whistleblower Award Programs Under State Securities Laws

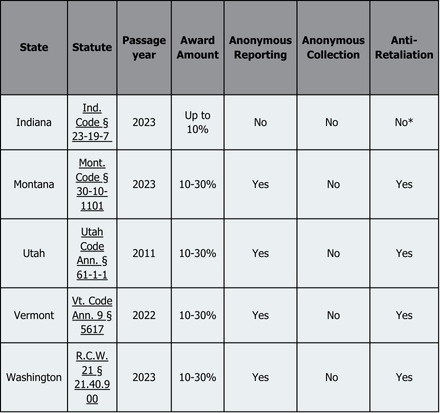

State-level whistleblower award programs aimed at violations of state securities laws are gaining momentum. While only a few states have dedicated programs, a growing number of states have adopted such initiatives in recent years. Notably, Indiana, Montana, Utah, Vermont, and Washington have established whistleblower award programs for reports of state securities law violations. Four states, Montana, Utah, Vermont, and Washington each have securities-specific anti-retaliation protections for whistleblowers with available civil remedies. The most recent additions to state-level securities whistleblower programs, Montana, Vermont, and Washington, are all based on model legislation from the North American Securities Administrators Association (“NASAA”).

Program Basics:

Underlying all five state securities whistleblower programs is the voluntary disclosure of original information regarding a violation of state securities laws to the appropriate state authority in the manner prescribed by statute. Each state defines original information as the whistleblower’s independent knowledge that is unknown to state securities officials and not exclusively derived from allegations in governmental hearings or reports.[1] An exception exists for information included in governmental reports if the whistleblower is the source of this information.[2] Those reporting alleged violations must generally provide, in writing, information about a securities violation that leads to a successful enforcement action resulting in a monetary sanction.

Across these programs, states have similar restrictions on who can receive an award. Generally across state programs, whistleblowers cannot recover if they: 1) have a legal duty to disclose the information, (2) are convicted of a crime in relation to the prohibited activity, (3) knowingly or recklessly provided false information, or (4) obtained the information from an audit required under securities laws.[3] Some states, like Montana, make additional carve outs prohibiting individuals who work for any governmental entity, both domestic and foreign, from receiving an award if they obtained the information while they were employed by that entity.

Indiana, the second state to enact a state securities whistleblower program, has the lowest program award that maxes out at 10% of the monetary sanction. In Montana, Utah, Vermont, and Washington, whistleblowers may receive from 10% to 30% of the monetary penalty obtained from a successful enforcement action. These award amounts are based on an aggregate amount, meaning the total award amount cannot exceed 30% even if there are multiple whistleblowers. All state programs require that the whistleblower’s information leads to successful enforcement actions and that a monetary sanction is paid prior to receiving an award. The amount of an award is largely discretionary across all state programs. Factors that influence the size of an award include: (1) the significance of the information provided to the success of an enforcement action, (2) the degree of assistance provided by the whistleblower, (3) state securities’ division programmatic interest in deterring securities violations, and (4) any other factors deemed relevant.[4] Utah also takes into consideration the costs of the whistleblower’s legal representation and the extent to which the whistleblower used internal compliance systems prior to reporting to the securities division.

Anonymity:

Most state programs allow anonymous whistleblowers to receive an award if they are represented by counsel. Utah and Indiana, however, do not allow anonymous award collection. Montana, Vermont, and Washington have explicit provisions allowing for a whistleblower to report anonymously.[5] These three states require that an anonymous whistleblower’s counsel disclose the identity of the whistleblower to the securities divisions in order to receive an award.

*Indiana has anti-retaliation laws related to reports of workplace health and safety violations. See Ind. Code 22-8-1.1-38.1.

[1] Ind. Code § 23-19-7-6; Utah Code Ann. § 61-1-102 (5); Mont. Code Ann. § 30-10-1103(3); Vt. Stat. Ann. 9 § 5617(b)(2); RCW 21 § 21.40.005(2).

[2] Ind. Code § 23-19-7-6; Utah Code Ann. § 61-1-102 (5); Mont. Code Ann. § 30-10-1103(3); Vt. Stat. Ann. 9 § 5617(b)(2); RCW 21 § 21.40.005(2).

[3] Ind. Code § 23-19-7-9; Utah Code Ann. § 61-1-106(4); Mont. Code Ann. § 30-10-1110; Vt. Stat. Ann. 9 § 5617(i); RCW 21 § 21.40.080.

[4] Ind. Code § 23-19-7-8; Utah Code Ann. § 61-1-106(3); Mont. Code Ann. § 30-10-1109; Vt. Stat. Ann. 9 § 5617(h)(2); RCW 21 § 21.40.070.

[5] Mont. Code Ann. § 30-10-1105; Vt. Stat. Ann. 9 § 5617(d); RCW 21 § 21.40.030.

This piece was written by Devan Eaton, The Anti-Fraud Advocacy Fellow at The Anti-Fraud Coalition.