U.S. Attorneys’ Offices By the Numbers: a Review of July 2024 through July 2025 Settlements

Thus far, 2025 False Claims Act settlement activity is shaping up to be more active than the first three quarters of 2024.* Using publicly available information from press releases, we compiled settlement data to illuminate trends in this space. From January 2025 through July 31, 2025, we saw a total of 171 publicly announced settlements and resolutions, while for the same time period in 2024 there were 126 settlements. Despite the larger number of recoveries for 2025 thus far, January 2024 through July 2024 outpaces 2025 in the amounts of money recovered. From January through July 2024, state and federal governments recovered over $3.3 billion whereas the same timeframe in 2025 saw over $1.7 billion in settlement recoveries. Nevertheless, the uptick in settlement activity marks an upwards trend in efforts to combat fraud.

*All figures are based on internal calculations done by TAF staff using data from press releases.

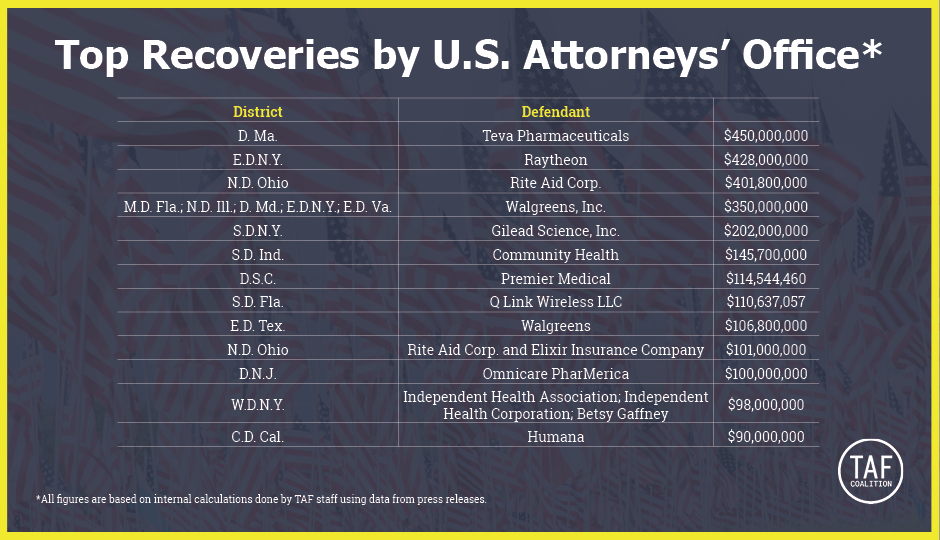

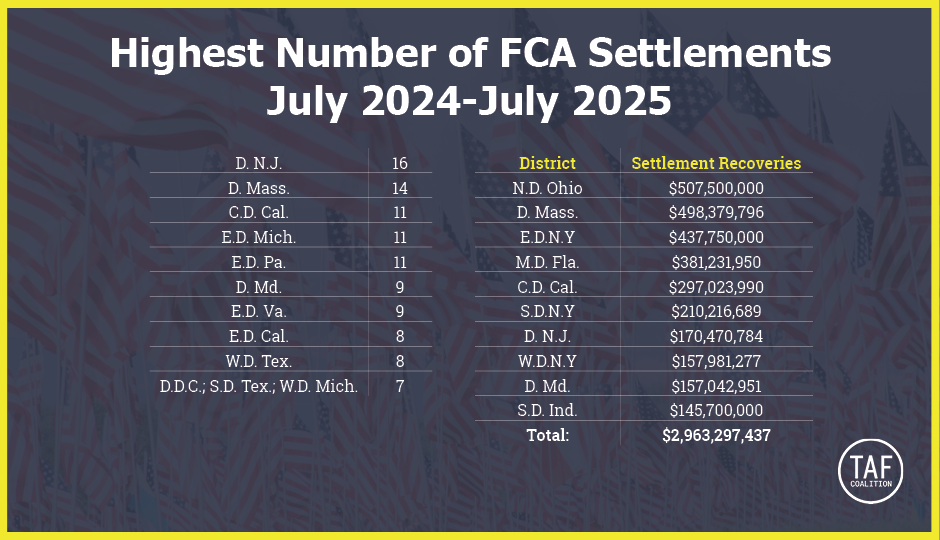

From July 2024 to July 2025, across both state and federal False Claims Act cases, 292 settlements were announced totaling over $4.9 billion. Settlement recoveries ranged from a low of $35,000 to a staggering $450,000,000, with the median settlement hovering at $2,505,000. Over 58.2% of settlements involved alleged fraud in the healthcare industry, including kickbacks and Medicare and Medicaid fraud. The next most common type of fraud involved the Paycheck Protection Program (“PPP”), with 18.8% of settlements involving PPP loans.

** N.D. Ohio amounts reflect settlement amount and not net recovery or award as the claim has been offset by an unsecured bankruptcy claim of $401M.

The districts with the highest number of successful cases during this time included the District of New Jersey, District of Massachusetts, Eastern District of Michigan, Central District of California, and Eastern District of Pennsylvania. However, the district which recovered the most from FCA settlements was the Northern District of Ohio, which recovered over $507 million. Of the successful settlements that originated as qui tams, the government intervened in 96.7% of cases.

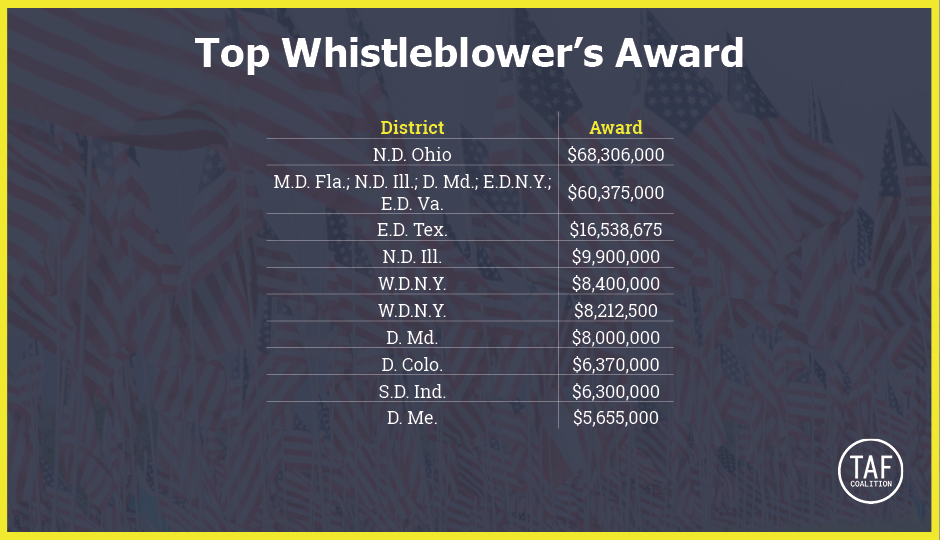

The highest reported whistleblower awards also belonged to government-intervened cases. Whistleblower awards totaled $274,473,485, with awards ranging from $22,662 to a high of $68.3 million. The median whistleblower award was $692,999.

** N.D. Ohio amounts reflect settlement amount and not net recovery or award as the claim has been offset by an unsecured bankruptcy claim of $401M.

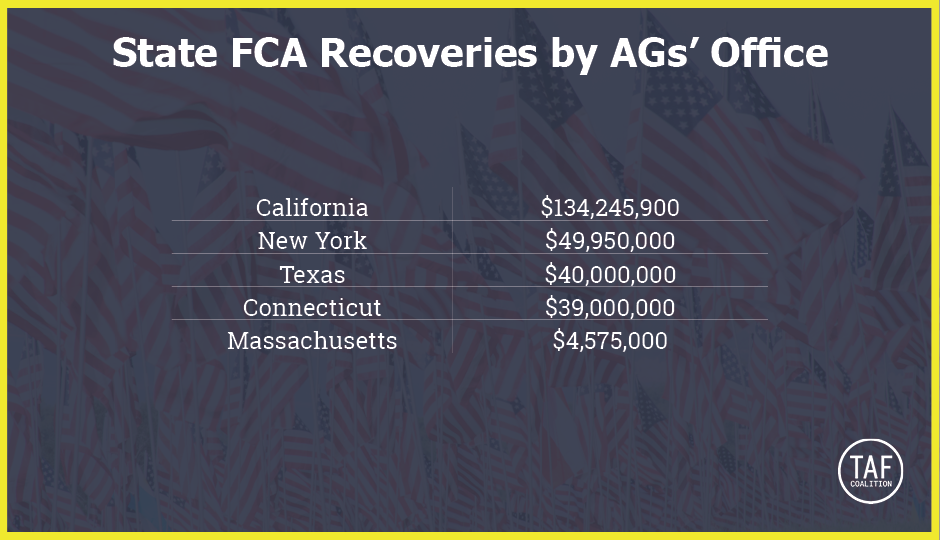

Amongst state attorney generals’ offices, California, New York, and Texas lead in recoveries. Overall, recoveries under state FCA cases totaled $271,123,374. Over two-thirds of state recoveries involved Medicaid fraud and the health care industry.

The numbers prove that U.S. Attorneys’ offices and states actively pursue fraud cases, big and small, and whistleblowers play a major role in those pursuits.

This piece was written by Devan Eaton, The Anti-Fraud Advocacy Fellow of TAF Coalition.