How Private Equity is Changing the Face of American Healthcare

Private equity investment in the healthcare space continues at a breakneck pace, resulting in profit-driven corporations living in the shadows of medical offices and hospitals around the country. As we reported last year, estimates of private equity deals in the healthcare space nearly tripled in value—from $43 billion to $124 billion—between 2010 and 2019. According to Bain’s 2023 “Global Healthcare Private Equity and M&A Report,” this trend continues. Bain reports that in 2021, total disclosed deal value reached $151 billion. The following year, although extraordinary market upheaval “shook private equity globally” and “pressure from a tight labor market hit healthcare particularly hard,” total disclosed deal value decreased only to $90 billion, reflecting the decade-long continued upward trend in private equity investment in healthcare.

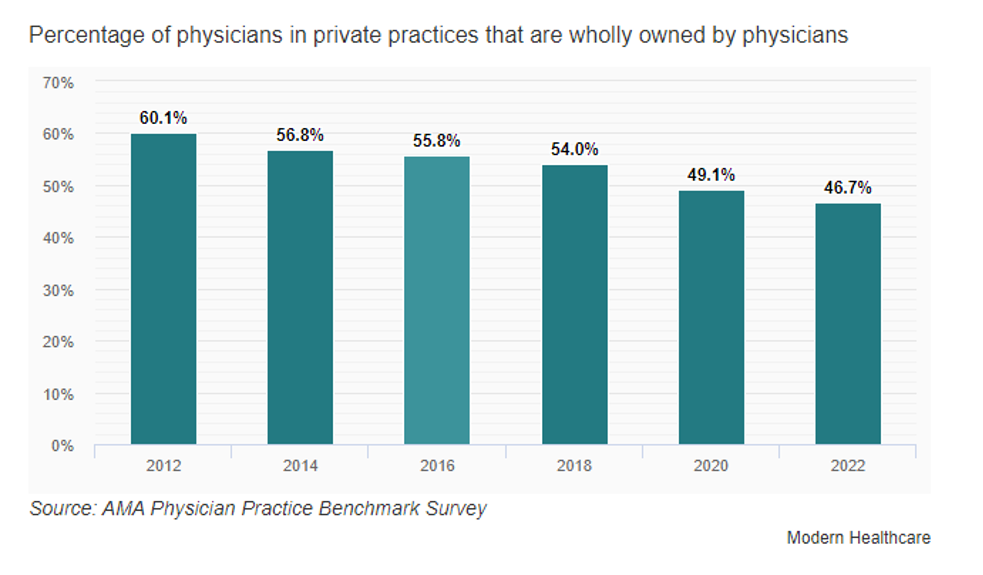

This trend is fundamentally changing the face of American healthcare. According to a recent study, private equity acquisition of physician practices increased more than six-fold between 2012 and 2022. Between 2019 and 2023, private equity accounted for 65% of physician practice acquisitions. These acquisitions are a meaningful component of the trending decrease in physicians who own their own practices.

Patients and payors alike have reason to be wary of private equity’s continued march into the healthcare space. Experts have expressed concerns that private equity’s “high-powered for-profit incentives” may be fundamentally “misaligned with the social goal of affordable, quality care.” A recent study analyzing 55 prior academic research studies, found that: (1) private equity acquisitions in every studied healthcare setting have increased in prevalence; (2) these investments “were most closely associated with up to a 32 percent increase in costs for payers and patients”; and (3) private equity ownership was “associated with mixed to harmful effect on care quality.” A 2021 working paper echoed these findings, concluding that private-equity ownership of nursing homes was associated with a 10% increase in short-term mortality of Medicare patients, representing an additional 20,150 lives lost over 12 years.

As we described last year, whistleblowers have been critical in monitoring private-equity-acquired medical providers for abusive and fraudulent behavior. This continues to be true. For example, in June of this year, private equity firm Belhealth Investment Partners, its principals, and their portfolio companies, Linden Care and Quick Care, paid $9 million to settle a whistleblower’s lawsuit alleging the defendants unlawfully distributed Subsys, a potent, rapid-onset fentanyl sublingual spray, in violation of the Controlled Substance Act.

To date, legislative efforts to require medical companies to disclose ownership by private equity and other financial firms have largely failed. Thus, whistleblowers remain patients and payors’ best protection against the dangers of acquired medical practices that substitute medical judgment for profit.

Molly Knobler is Senior Counsel at DiCello Levitt and Jillian Estes is a Senior Attorney at Morgan Verkamp.