Private Equity Investment in Healthcare is Skyrocketing; Grandma Should Be Scared

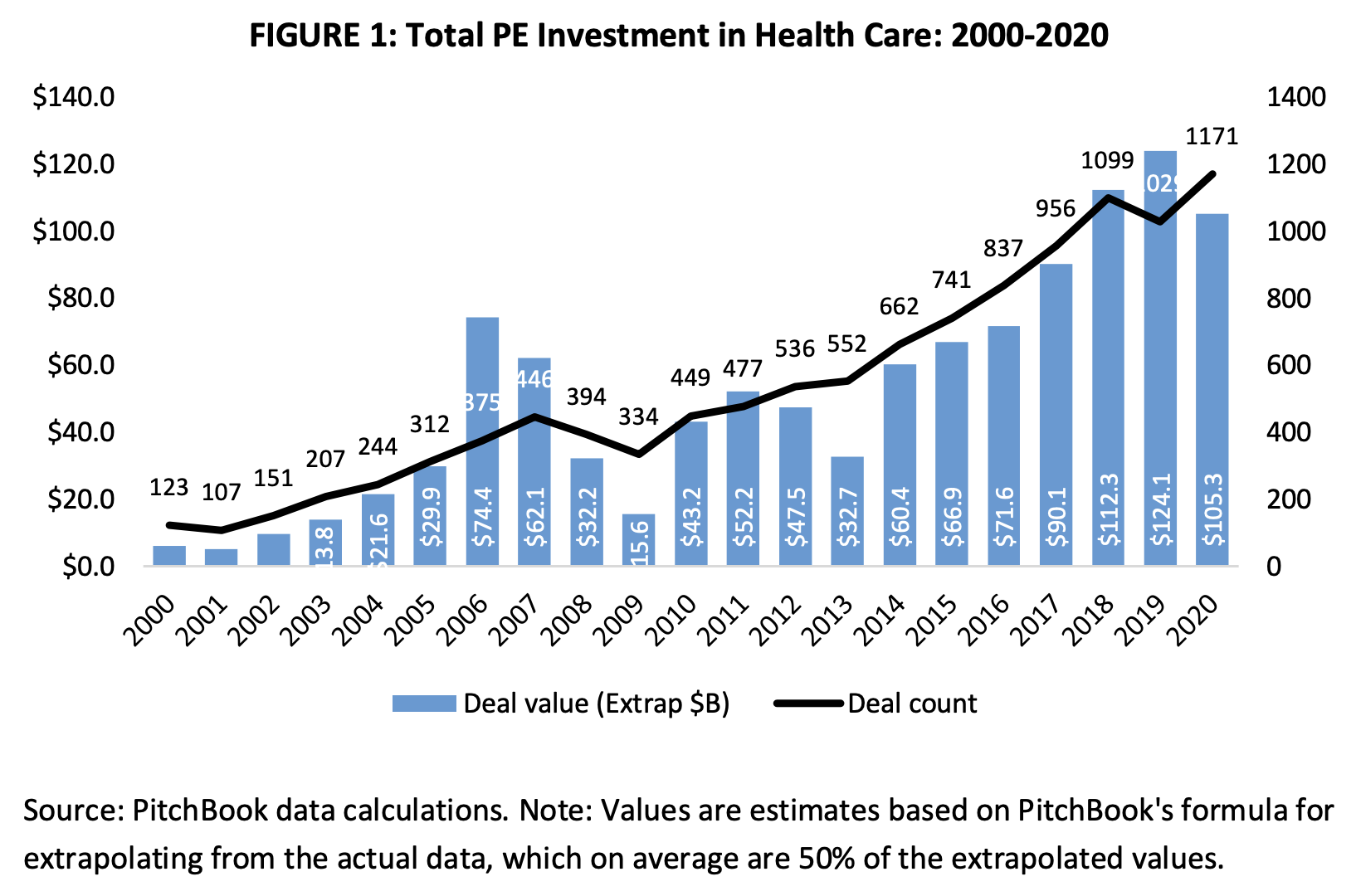

Private equity investment in healthcare providers has skyrocketed over the last decade. Between 2010 and 2019, private equity deals in healthcare nearly tripled in value—from $43 billion to $124 billion—totaling $750 billion over the last decade. That’s more than the combined budgets of the Department of Agriculture, the Department of Veterans Affairs, and the Department of Transportation this year.

A “private equity” (or “PE”) investment means capital that comes from institutional funds and individuals that invest directly in private companies, rather than through a public exchange. Private equity fund managers often take an active hand in managing the day-to-day operations of the “portfolio” companies in which they invest.

As a result, over the last ten years, a relatively small group of investors subject to little regulation or transparency have shifted the focus of healthcare – from optimizing patient care, to maximizing investor returns.

All this private equity investment has major downsides for health care according to a recent study published by the University of Chicago. The report found that private equity ownership of nursing homes was associated with an increased probability of death during a patient’s stay and in the 90 days following discharge. The authors’ analysis implied about 20,150 Medicare lives lost due to PE ownership of nursing homes between 2000 and 2017.

The study also found that patient care suffered when private equity took over, including a decline in nurse availability per patient and a 50% increase in the likelihood of patients receiving antipsychotic medications (which are strongly discouraged in the elderly due to their association with greater mortality).

In addition to the tragic personal tolls, financial costs increased as well. The study found an 11% increase in the amount billed for the stay and the 90 days following the stay and an increase in operating costs that tended to drive profits for the PE owners. Private equity ownership of nursing homes has also been linked to unethical or illegal billing practices, including “surprise medical billing.”

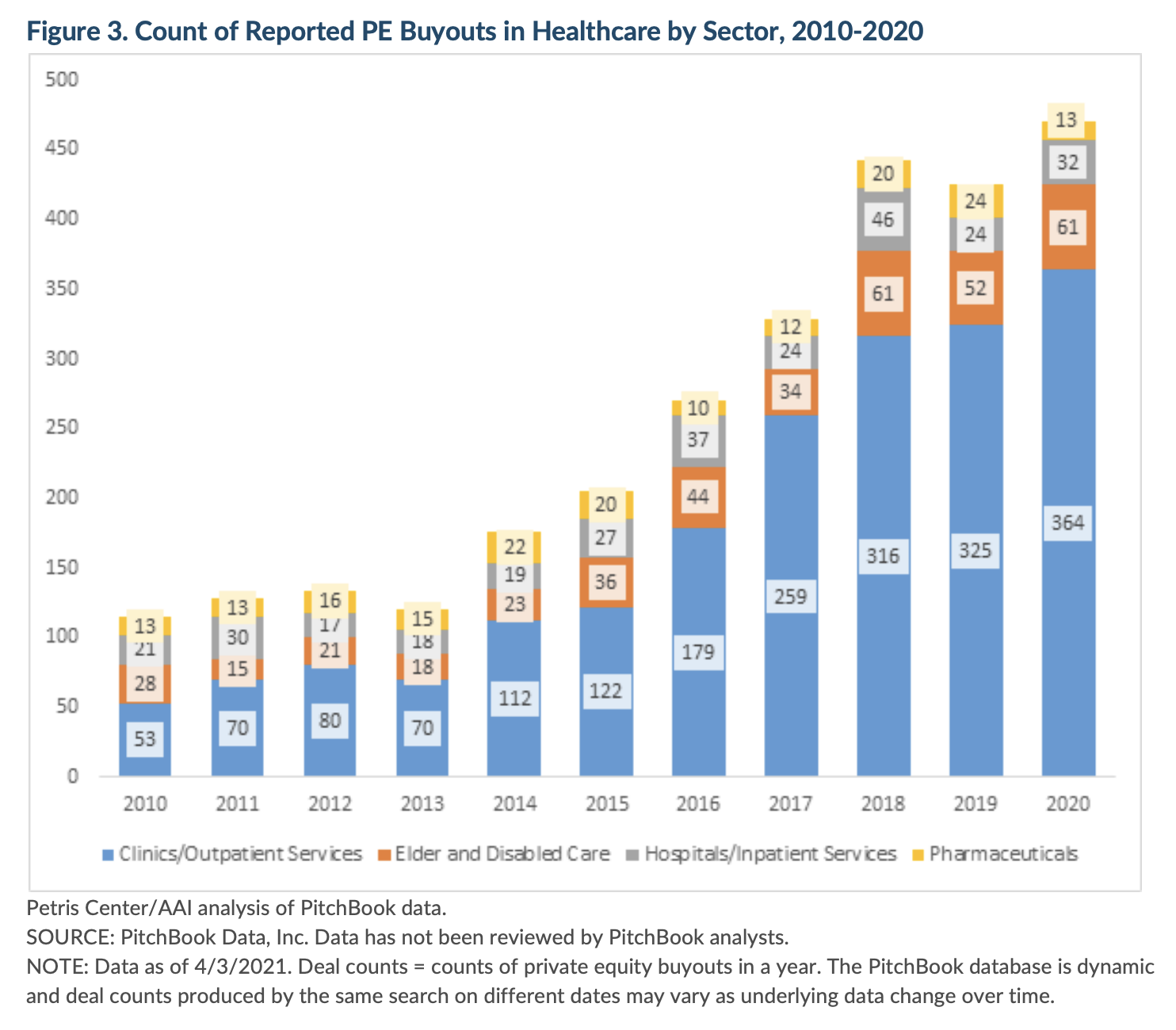

Private equity investments have focused disproportionately on outpatient care and home health markets, though there has also been substantial investment in hospitals, particularly emergency room services, and pharmaceutical companies.

In addition, since 2013, at least 25 private-equity owned healthcare companies (and sometimes the private equity owners themselves) have entered into settlements or been subject to judgments totaling almost $614 million1 to resolve claims that they fraudulently overcharged government payers. Every single one of those 25 cases was initiated by a whistleblower.2

These whistleblowers not only protect the solvency of government healthcare programs; they protect patient welfare. As PE investments in healthcare continue to increase exponentially, so too will the need for whistleblowers to expose the fraudulent and abusive billing practices that too often go hand-in-hand with deficient or harmful patient care.

Written by By Molly Knobler of Phillips & Cohen LLP. Edited by Kate Scanlan of Keller Grover LLP and Tony Munter of Price Benowitz. Fact checked by Julia-Jeane Lighten of Taxpayers Against Fraud.

1 & 2 Sources on file with author.