The Strong Value of Expansive State False Claims Acts

The federal government is the largest purchaser of goods and services in the world. With big spending bills such as the American Rescue Plan ($1.9 trillion) and Inflation Reduction Act ($369 billion) dominating the headlines, state government spending is sometimes overlooked. But state governments are economic powerhouses in their own right, and state spending is equally susceptible to fraud.

In FY 2021, the fifty states and the District of Columbia combined to spend approximately $2.68 trillion—a figure equivalent to nearly forty percent of that year’s federal budget. Of those expenditures, 26.9% went to Medicaid, meaning that the states spent approximately $1.96 trillion on non-Medicaid purchases in FY 2021. That’s nearly two percent of global GDP—the combined national income of every country in the world. And where money goes, fraud is sure to follow.

Fortunately, many states are equipped with robust whistleblower laws to punish and deter wide-ranging misconduct. Twenty-four states and the District of Columbia have False Claims Acts (FCAs) that permit a whistleblower to bring a qui tam suit based on Medicaid or non-Medicaid fraud. Several jurisdictions—Illinois, Indiana, Maryland, New York, Rhode Island, and the District of Columbia—go a step further, providing rewards for whistleblowers who report tax fraud.

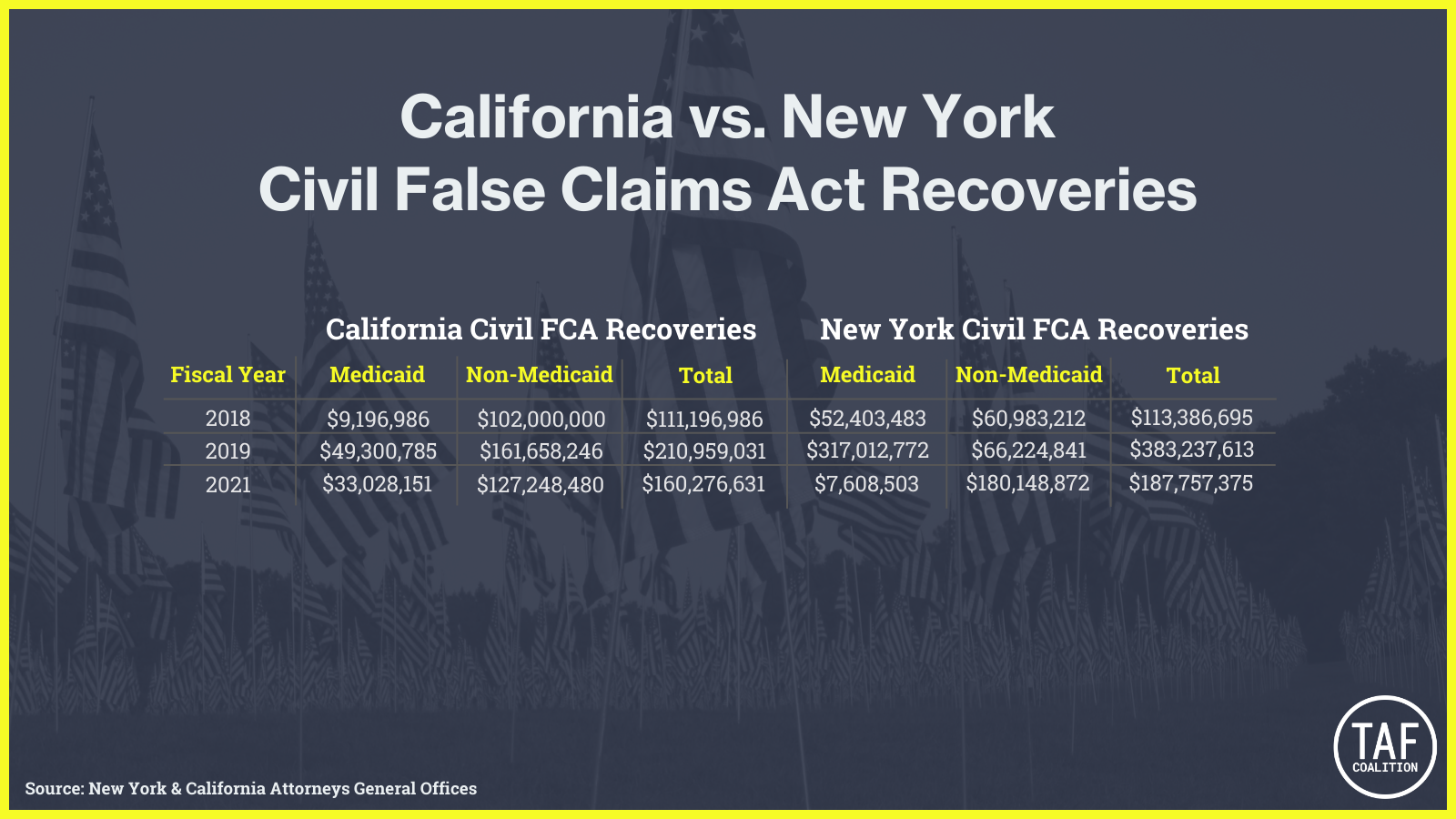

However, several states—Connecticut, Louisiana, Michigan, New Hampshire, Oklahoma, Texas, and Washington—limit their FCAs to fraud against the Medicaid program. By enacting these more restrictive FCAs, these states may be missing out on hundreds of millions of dollars in additional recoveries for two reasons. First, Medicaid accounts for only a small minority of state spending. Second, because Medicaid is a joint federal-state program, states must share a significant portion of any Medicaid fraud recovery with the federal government. Consider two examples of states with wide-ranging FCAs: California and New York. Both states’ FCAs apply to Medicaid and non-Medicaid spending, and New York’s FCA applies additionally to tax fraud. The following charts show each state’s Medicaid recoveries and non-Medicaid recoveries in civil matters from FY 2018 through FY 2020. In each year, the non-Medicaid recoveries generally exceeded the Medicaid recoveries:

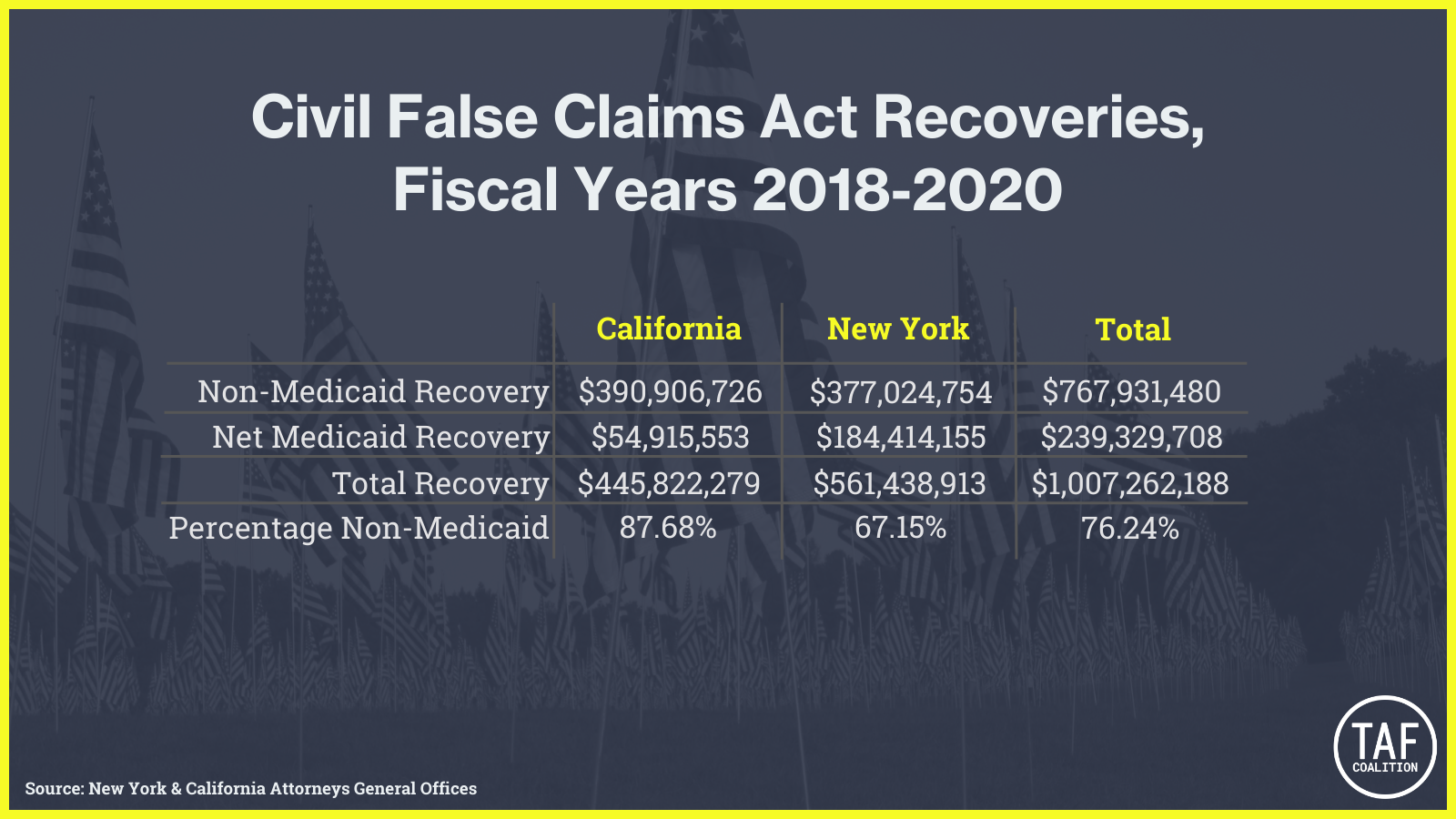

These differences are even more stark when considering that Medicaid is jointly funded by the states and the federal government. That means that when a state achieves a recovery for fraud against the Medicaid program, it must share a significant portion of that recovery with the federal government. For example, in California and New York, for every $1 the state recovers in a Medicaid fraud case, $0.40 must be returned to the federal government. Thus, each state’s net Medicaid recoveries pale in comparison to its non-Medicaid recoveries:

If these states had limited their FCAs to fraud on the Medicaid program, they would have recovered about $239.3 million over this three-year period. But because their statutes permit whistleblowers and the government to combat fraud against other government programs, they were able to recover an additional $767.9 million, representing more than three-quarters of their total recoveries.

These two examples represent just the tip of the iceberg. With state spending continuing to rise and fraudsters devising ever more sophisticated schemes, states with Medicaid-only FCAs are potentially leaving hundreds of millions of dollars on the table.

Noah Rich is an Attorney at Baron & Budd

[1] Data for Medicaid recoveries for both New York and California are drawn from the annual Medicaid Fraud Control Unit reports published by the Department of Health & Human Services Office of the Inspector General, available at https://oig.hhs.gov/fraud/medicaid-fraud-control-units-mfcu/.

[2] https://www.jdsupra.com/legalnews/california-s-false-claims-act-has-5866415/[3] Data for non-Medicaid recoveries are drawn from public sources and may understate the actual amount recovered.