What would government FCA enforcement recoveries look like without qui tams?

In his recent dissent in U.S. ex rel. Polansky v. Executive Health Resources, Justice Clarence Thomas suggested that qui tam actions, allowing private individuals to represent the government in litigation, might be unconstitutional. Seizing upon Justice Thomas’ speculation, False Claims Act defendants have intensified constitutional challenges to the qui tam provisions even though the issue was resolved more than 30 years ago when the False Claims Act was amended to give the government increased control over qui tam actions. Nonetheless, it is worth considering what False Claims Act enforcement might look like without qui tams.

The False Claims Act is first and foremost a law empowering the U.S. Department of Justice to prosecute fraud on the federal government through civil lawsuits. 31 U.S. Code § 3730, the section of the FCA which authorizes civil lawsuits, begins by stating: “The Attorney General diligently shall investigate a [False Claims Act] violation. . .If the Attorney General finds that a person has violated or is violating [the FCA], the Attorney General may bring a civil action under this section against the person.” The section continues by establishing the FCA qui tam mechanism by which whistleblowers (relators) may initiate individual FCA lawsuits on behalf of the government.

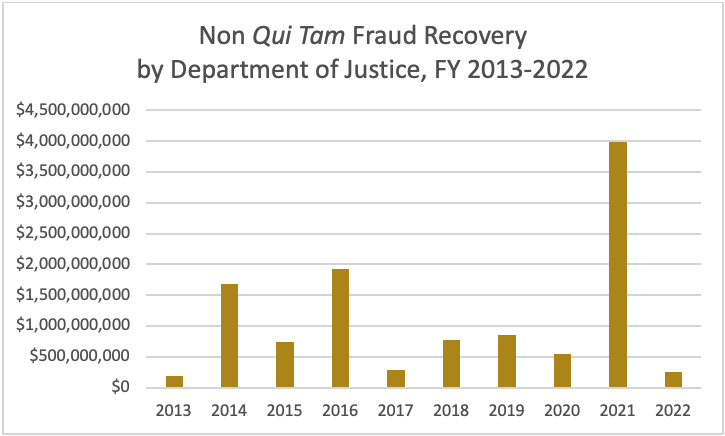

But what would the False Claims Act look like without qui tam provisions? In such a world, the Department of Justice would have to investigate and initiate actions under the False Claims Act exclusively using the government’s own resources and sources of information. DOJ regularly brings such government-initiated actions and they do recover hundreds of millions of dollars (but usually less than $1 billion) per year:

The outlier year in the above chart is 2021, when government initiated cases purportedly recovered about $4 billion, more than twice the size of the second largest amount in 2016. The extraordinary 2021 figure is explained by a single recovery: “an allowed, unsubordinated, general unsecured bankruptcy claim for $2.8 billion” against Purdue Pharma to resolve civil allegations related to the knowing promotion of opioid drugs to health care providers. However, because the Purdue claim is tied up in bankruptcy litigation, its true value is very uncertain.[1]

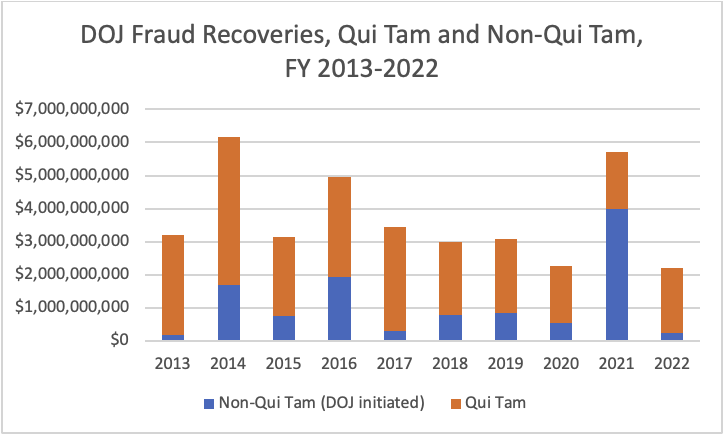

The amount brought in on non-qui tam FCA enforcement is consistently dwarfed by the amount recovered through qui tam actions, even though there are less than a thousand qui tams filed each year. As we previously covered, qui tam recoveries have declined in recent years, but have averaged about $2.59 billion per year in the past ten fiscal years. Government-initiated cases averaged about $1.12 billion per year in the same period (and that number is only about $803.7 million once the year 2021 is excluded).

Government-initiated actions contributed an annual average of 26.2% of all fraud money recovered by the government. Without the 2021 amount, that percentage shrinks to about 21.4%.

The below chart illustrates the contribution of qui tam vs. government-initiated actions to the total fraud recovery amount each year.

It is safe to assume that relying on government-initiated FCA actions would drastically reduce the amount of money that is recovered from fraudsters each year. The low share of money recovered through government-initiated actions is not surprising: it is precisely the government’s limited resources and the difficulty of acquiring insider information to prove fraud cases that propelled Congress to pass the False Claims Act in the first place. Fraudsters who have been exposed by whistleblowers latching on to the lone and unsupported Polansky dissent in an attempt to silence those whistleblowers is equally unsurprising.

Nicolas Mendoza is an Associate at Murphy Anderson PLLC

[1] Although DOJ celebrated the claim as a major victory and included it in its 2021 numbers, the $2.8 billion claim has yet to result in any money actually recovered for taxpayers, as it is dependent on the approval of Purdue’s bankruptcy plan, which has been tied up in litigation and which the Supreme Court paused pending arguments scheduled for December.