IRS Whistleblower Program Report Shows Increase in Award Amounts, Processing Times

Earlier this year, the Internal Revenue Service Whistleblower Office released its Annual Report with an encouraging word from the program’s director.

In the report, Director Hinman reiterated the IRS’s support for whistleblowers, and said that the agency “uses increasingly sophisticated data analytics and other methods to detect non-compliance with tax laws, but we can’t find it all by ourselves. We need help from whistleblowers—people with firsthand knowledge of non-compliance who are willing to share what they know with us so we can investigate it when warranted.”

The Fiscal Year 2022 Report covered the time period from October 1, 2021, to September 30, 2022, and provided information related to the last ten years of the program issuing awards. A variety of performance factors show that although the program increased the total dollar value of awards paid out last year, it struggled to lessen the amount of time it takes to issue awards.

Specifically, the IRS Whistleblower Office, which received more than 5,000 Form 211 submissions and identified more than 12,500 claims based on those submissions in FY 2022, issued whistleblowers 132 awards in FY 2022 totaling $37.8 million. Further, the IRS Whistleblower Office closed more than 11,600 claims in FY 2022. Although the total dollar amount of awards increased from FY 2021 ($36.1 million), the actual number of awards decreased from the 179 that were issued the prior year.

While FY 2022 showed a slight increase in the amount of awards given to tax whistleblowers, a more significant increase will be required if the IRS is to reverse the overall declining trend in amounts paid starting in 2018.

Further, although award amounts ticked up in 2022, the amount of time the IRS Whistleblower Office takes to issue awards actually increased. According to the Annual Report, award payment processing times for both Section 7623(a) and (b) increased by 14.9% and 1.3%, respectively.

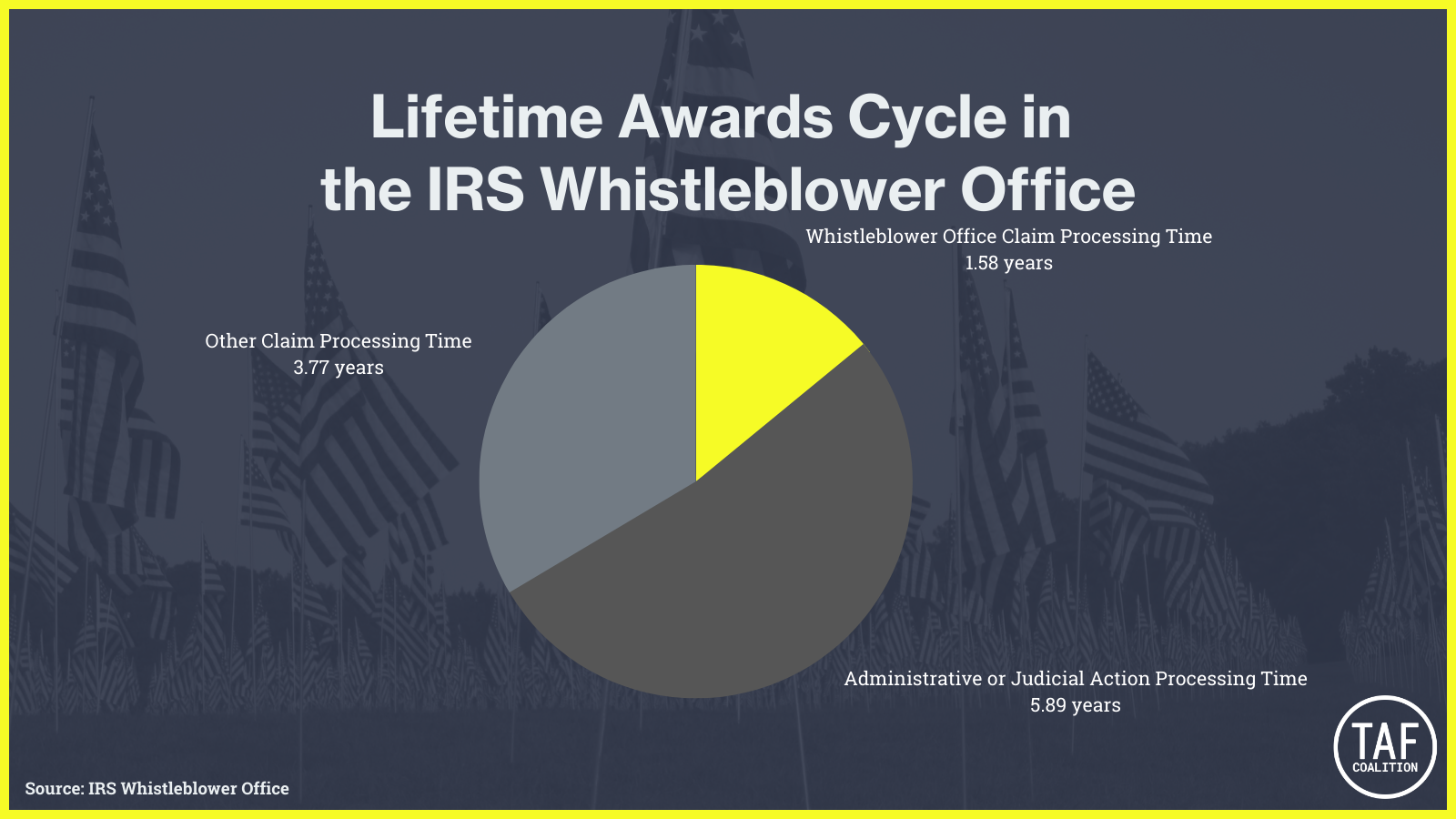

According to the IRS report, the average amount of time it takes for Section 7523(b) claims to go from the process of submission to payment sits at 11.24 years while the same cycle for Section 7623(a) claims is 9.79 years. Looking further into these numbers, the IRS broke down how long each stage of a Section 7623(b) claim typically takes. According to the agency’s breakdown, the 11.24-year awards cycle typically looks like this:

The Annual Report noted the range of time for specific claims process stages (shortest to longest), including:

– OD Field (Examination and Investigation) from 0.5 to 8.53 years.

– Collection of Proceeds from 0.19 to 19.98 years.

– Related Claims in Progress from 0.67 to 6.42 years.

– Taxpayer Appeals or Litigation Stage from 0.36 years to 2.92 years.

– Waiting Period for Expiration of Refund Statute from 0.01 years to 2.93 years.

Overall, practitioners seem heartened by the fact that the IRS Whistleblower Office continues to emphasize the importance of whistleblowers as the program works toward a variety of improvements, including a digital submission platform. Along with an increase in the value of total awards dispersed this last fiscal year, the IRS Whistleblower Program, which collected more than $172 million in proceeds for the U.S. government in FY 2022, continues to show effectiveness in rooting out fraud.

Matthew Beddingfield is a Senior Associate at Zerbe, Miller, Fingeret, Frank & Jadav LLP.