Deciphering Crypto Fraud

Given cryptocurrency’s massive market cap and propensity for volatility, it is no surprise that cryptocurrency is a hot new topic among government agencies tasked with tracking and prosecuting fraud. According to Pew Research, 16% of Americans have invested in, used or traded crypto, and that number jumps to 31% of Americans ages 18 to 29. Crypto usage did not vary much among income groups, at 17% for people in the upper and middle-income categories and 15% for people in lower income brackets.

As crypto investments have increased, so too has the number of victims of cryptocurrency fraud. The FTC announced this year that between January 2021 and March 31, 2022, more than 46,000 people reported losing a total of over $1 billion worth of cryptocurrency in scams. Those figures only include scam victims who chose to report to the FTC, so the real numbers of victims and lost investments may be higher. In fact, a Chainalysis report on crypto crime in 2021 uncovered larger amounts of crypto fraud than the amount reported to the FTC, with “illicit addresses” receiving over $14 billion in cryptocurrency1.

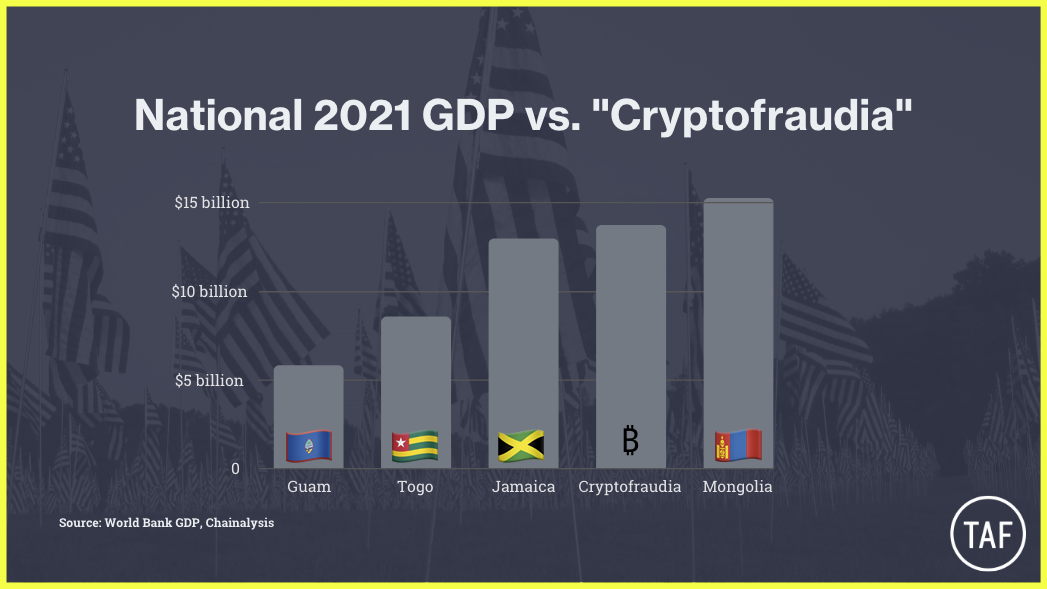

To put that in perspective, if we imagine a fictional country called Cryptofraudia with a GDP of $14 billion, that country would have a higher Gross Domestic Product (GDP) than about 70 countries on the World Bank’s 2021 ranking, including Armenia and Jamaica. This $14 billion directed to “illicit addresses” represents a $6.2 billion increase from 2020 data. This annual jump is also a gargantuan figure, larger than the GDP of Guam.

Overall, there were 60 times more reported crypto scams in 2021 than in 2018. The average victim lost $2,600, which is more than two weeks’ pay for someone making the mean annual wage in the U.S. Crypto schemes such as “rug pulls”, in which developers of a cryptocurrency pump up the price of the cryptocurrency and then sell their shares, often leave investors blindsided and financially devastated. The largest confirmed rug pull defrauded investors of more than $4 billion in 2017 alone.

While crypto fraud numbers are ballooning, enforcement efforts are still ramping up. The SEC established a Cyber Unit in 2017. It has nearly doubled in size and operates under the new moniker “Crypto Assets and Cyber Unit” in 2022 to reflect the growing prevalence of crypto and cyber crimes. In October 2021, the Dept. of Justice created a National Cryptocurrency Enforcement Team tasked with prosecuting virtual currency exchanges, money laundering and crypto ransomware.

More recently, Senators Cynthia Loomis (R-WY) and Kirsten Gillibrand (D-NY) introduced a bipartisan bill called the Responsible Financial Innovation Act to define cryptocurrency as a commodity under the purview of the Commodity Futures Trading Commission.

At the state level, New York Attorney General Letitia James issued a call for insiders at unscrupulous crypto companies to step up as whistleblowers – and to defrauded investors to reach out to her office, too. And recently, SEC Chair Gary Gensler has made multiple public comments expressing the need for enforcement in the crypto space and his belief that “a majority of crypto tokens are securities.”

The growing ubiquity of the crypto market and the rising GDP of Cryptofraudia suggest that the push for enforcement, supported by whistleblowers, is coming not a moment too soon.

Written by Elizabeth Soltan of Constantine Cannon LLP and Alex Cala of Taxpayers Against Fraud. Edited by Jillian Estes of Morgan Verkamp LLC, Kate Scanlan of Keller Grover LLP, and Tony Munter of Price Benowitz. Fact checked by Julia-Jeane Lighten of Taxpayers Against Fraud.

1. To access the free report, visit https://go.chainalysis.com/2022-Crypto-Crime-Report.html and enter your name.