A Tradition of Fraud Persists in New Types of Medicare Delivery Models

The “traditional” Medicare model[1] – under which the government pays medical providers for each service on a fee-per-service basis – will soon no longer be the standard model through which Medicare beneficiaries receive coverage and providers are paid. This year, 48% of Medicare beneficiaries are covered by a “Medicare Advantage” plan. Next year, if trends continue as expected, this percentage will be higher. The Congressional Budget Office projects that 61% of Medicare beneficiaries will be enrolled in Medicare Advantage plans by 2032.

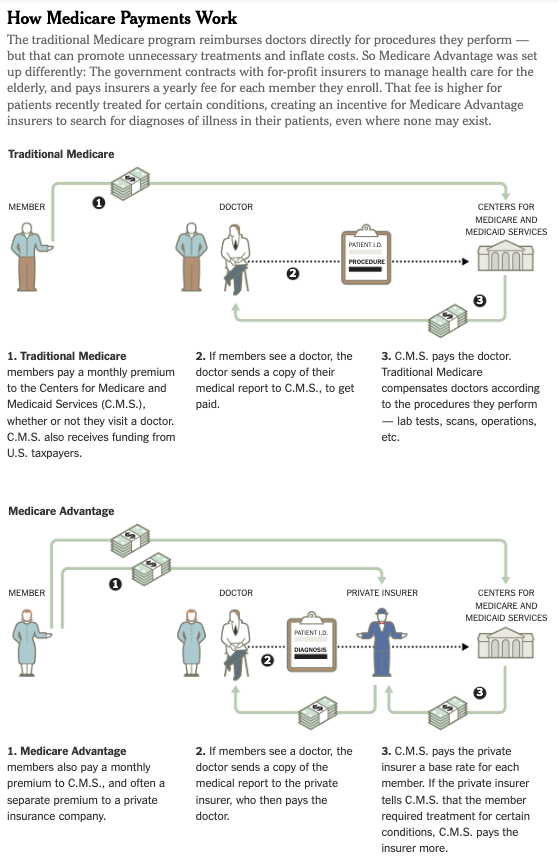

Under the Medicare Advantage model, the government contracts with private insurers to provide all care to which beneficiaries would be entitled under “traditional” Medicare. The government pays the Medicare Advantage insurers a “capitated” rate, i.e., a set amount per-member-per-month. That payment is not directly affected by each charge or service a beneficiary receives, but rather by the members’ health status and demographics. Medicare Advantage insurers then contract with medical providers to provide care. They may pay providers on a fee-for-service basis, through a capitated rate, based on quality outcomes and cost savings, or through a mix of these models. Sometimes, Medicare Advantage insurers even own and operate the providers that they contract with.

One of the primary reasons the Medicare Advantage program was created was to “take advantage of efficiencies in managed care and save Medicare money.” But instead of saving the government money, the program is so far costing taxpayers more on average. This year, 48% of Medicare beneficiaries are covered by a Medicare Advantage plan but they account for 55%of total federal spending on Medicare. This has been a consistent trend in the program. It is not clear yet why this is the case, although in future blogs we will examine frauds specific to the Medicare Advantage program.

In addition, many of the traditional kinds of fraud also affect Medicare Advantage. Unscrupulous medical providers, hospitals, and drug manufacturers, can and do defraud Medicare Advantage plans in the same ways they defraud “traditional” Medicare. For decades, False Claims Act practitioners have pursued corrupt medical providers who defraud Medicare and drive up costs by performing medically unnecessary services, billing for services not provided, and/or submitting claims tainted by kickbacks and improper financial arrangements. And, according to Kaiser Health news, recent Medicare Advantage audits are already showing this pattern materialize. These schemes – when perpetrated on Medicare Advantage plans – increase costs to the plans, and, by extension, the government and the American taxpayer, while pushing up healthcare costs for all consumers.

The Department of Justice has shown that it is concerned about Medicare fraud generally and fraud on the Medicare Advantage program specifically. In its most recent press release touting its annual settlements and judgments, the Department specifically called out its efforts to combat “Health Care Fraud,” including specifically fraud in the Part C program, kickbacks, and unnecessary medical services. Members of Congress have taken notice as well.

The growth of Medicare Advantage means we will need more whistleblowers and government focus to fight traditional and new kinds of fraud against Medicare, the future of the program depends on it.

Molly Knobler is Senior Counsel at DiCello Levitt

[1] Traditional Medicare is also called Medicare Part A and Part B. Medicare Advantage is also called Medicare Part C.