Trendlines at the SEC and CFTC Whistleblower Programs

The Security and Exchange Commission and the Commodity Futures Trading Commission Whistleblower Programs: More awards, more money recovered, more money returned to investors and more disclosures of fraud—It’s not an accident

Today we begin our annual Fraud by the Numbers series with a look at the results obtained by the SEC and CFTC whistleblower programs. Tomorrow Nicolas Mendoza will examine the Department of Justice’s reports on False Claims Act cases, which are brought to fight fraud against the Government.

The SEC and CFTC whistleblower programs have been issuing an increasing number of awards for successful disclosures, and some very large awards have been getting headlines. Correlation is not always causation, but it is notable that the greater number of awards and publicity correlates with dramatic increases in disclosures made by whistleblowers to both programs.

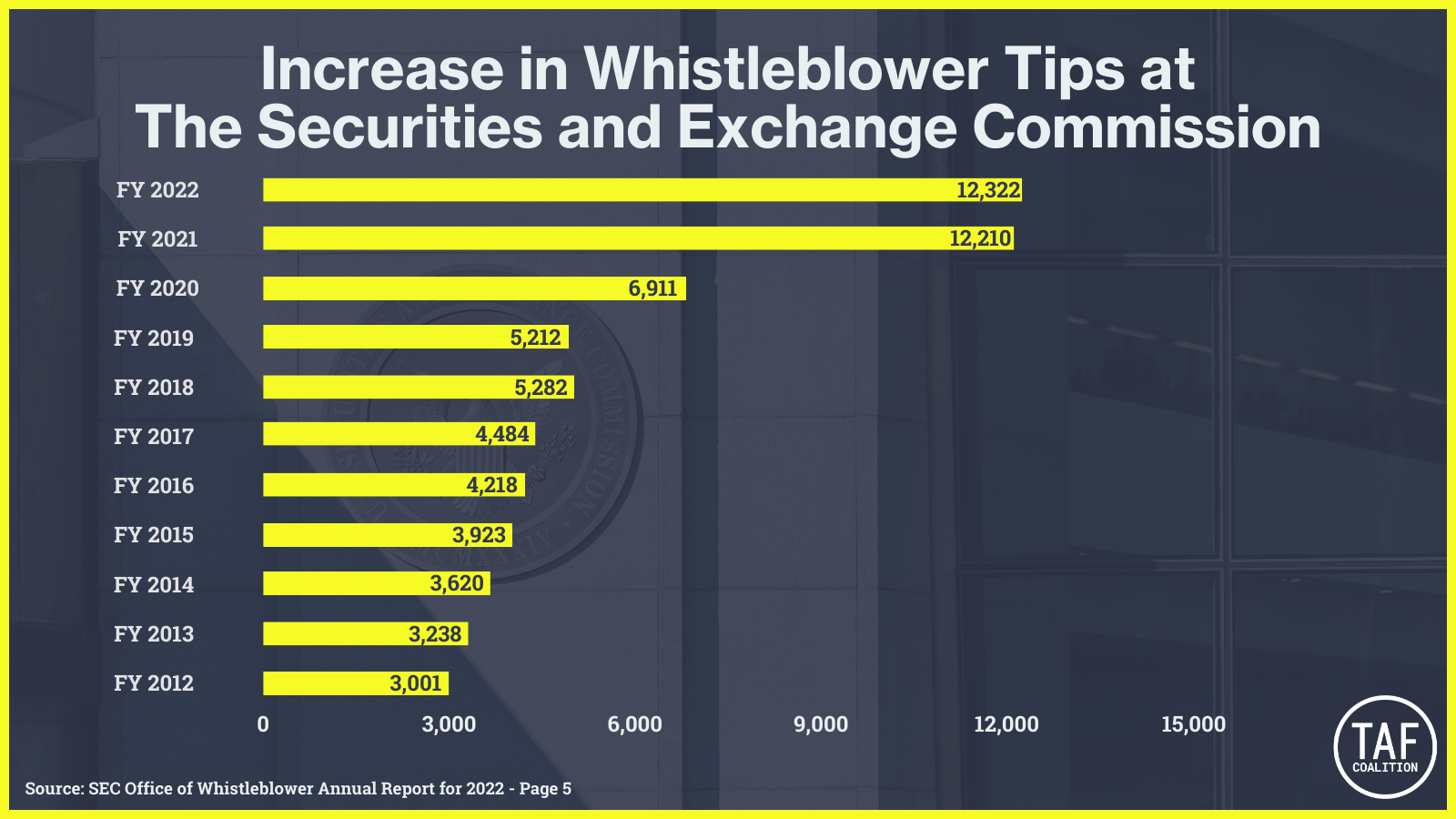

For the second year in a row, the SEC reported a record number of whistleblower disclosures.

Check out this chart from the FY 2022 annual SEC whistleblower report:

The SEC received 24,532 reports from whistleblowers between 2021 and 2022, substantially more than in the previous four years combined (21,889). In FY 2022, the SEC gave out the second highest number of awards in its history—approximately 103 awards totaling $229 million. OWB Report, page 1.

Those awards likely stem from cases filed years ago, when fewer tips were coming into the SEC, so we will be checking to see if the recent higher volume of whistleblower disclosures leads to a larger annual number of awards in the future. In May of 2023, the SEC announced its largest award in the program’s history, $279 million, which generated more publicity for the whistleblower program.

The big awards get headlines, while the real effect of the program often gets less attention. Big awards to whistleblowers mean even bigger amounts of money returned to investors who were harmed by fraud.

The 2022 SEC report shows the impact of the awards that the SEC authorized that year:

Enforcement actions brought using information from meritorious whistleblowers have resulted in orders for more than $6.3 billion in total monetary sanctions, including more than $4.0 billion in disgorgement of ill-gotten gains and interest, of which more than $1.5 billion has been, or is scheduled to be, returned to harmed investors.

That’s a total of more than $10 billion in enforcement actions generated, at least in part, by the efforts of whistleblowers.

SEC whistleblower awards are intended to be incentives for whistleblowers to report violations of the securities laws, and the OWB Report provides evidence that the incentive is working to generate more disclosures for the Commission to investigate.

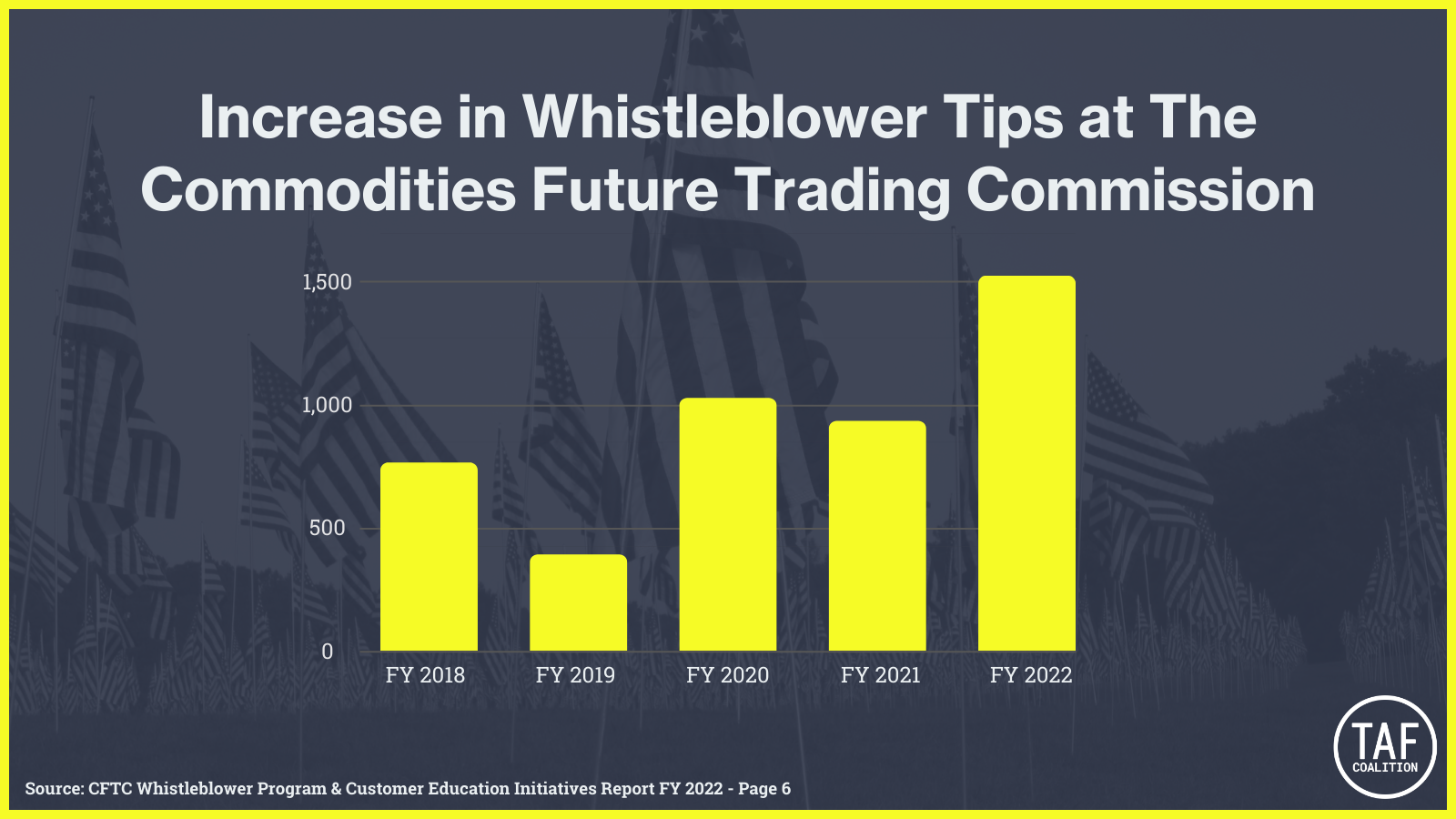

The CFTC also made a splash with its largest ever award of $200 Million in October 2021. At the time the award was the largest given under either the CFTC or SEC programs. The award was for information about a massive fraud by Deutsche Bank to manipulate the LIBOR bank rate, a rate that affected interest rates across the world of finance. Deutsche Bank had to pay billions in fines, and now bank rate manipulation is something everyone knows can be prosecuted.

Not surprisingly, disclosures to the CFTC whistleblower program are also on the rise as its 2022 report indicates:

Awards from these programs are demonstrating to potential whistleblowers that they can report fraud safely to a government agency that will do something with the information. Giving out real awards on a regular basis and protecting whistleblower anonymity correlates with results for the enforcing agencies. The results also mean more disclosures of fraud to the SEC and CFTC, who can work to fight fraud in the markets and return money to harmed investors.

We can’t always prove correlation is causation, but we can say these programs are getting results.

Tony Munter heads the Whistleblower Reward Practice at Price Benowitz, LLP