The Success of State Level False Claims Act Legislation Highlights Fraud Enforcement Victories

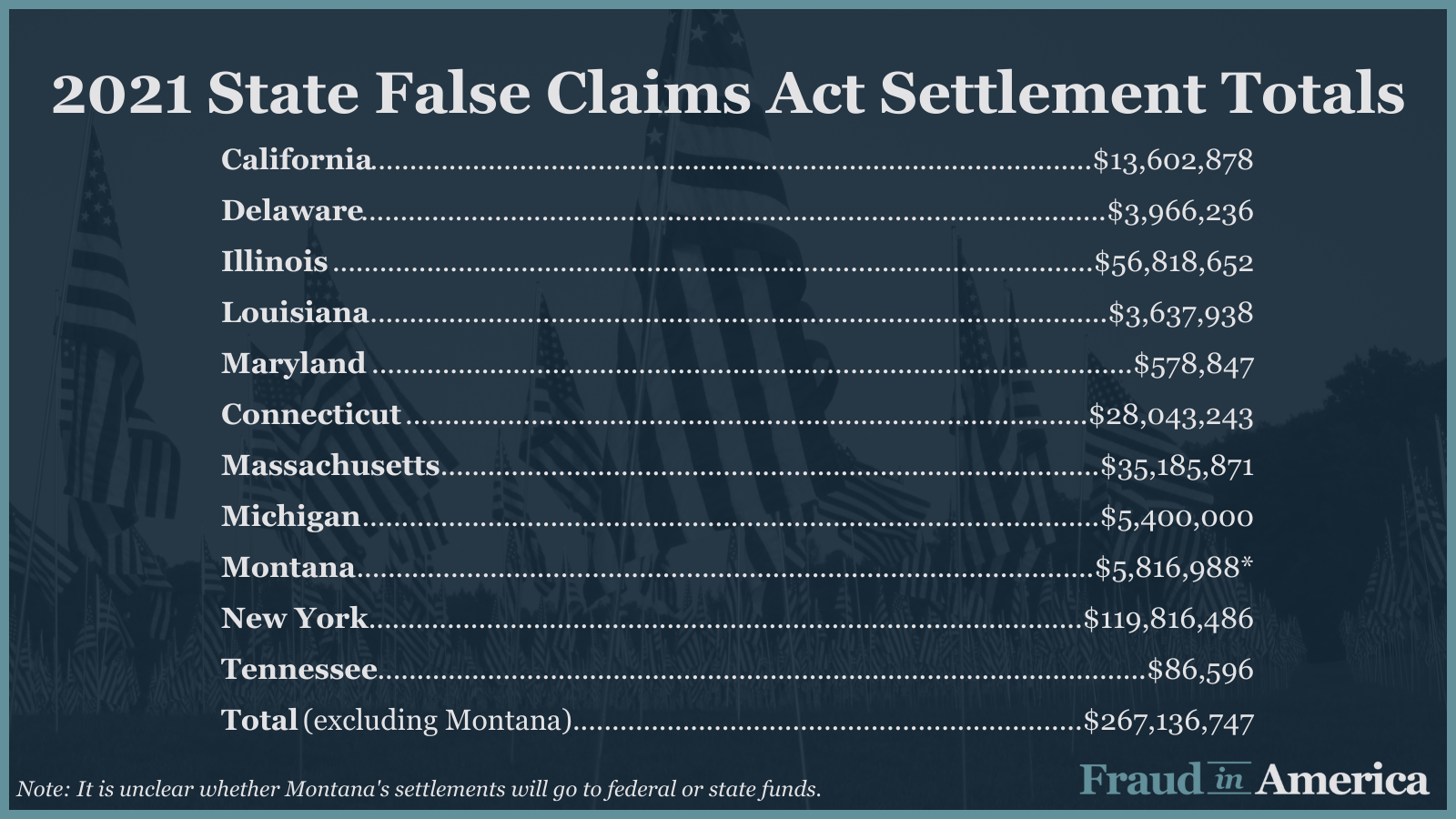

In 2021, of the 31 states that have some form of a False Claims Act, 11 were able to leverage this legislation to obtain millions of dollars in compensation for their state. These settlements come to a total of $287,136,747.[1] The immense success of these 11 states demonstrates the need for more focus on potential State fraud cases, and the need for more State False Claims Act.

New York Illustrates the Need for State False Claims Act Legislation Including Tax Fraud

New York state’s settlements had the highest monetary value, with a total of $119 million recovered for the state. New York is also the exception in terms of the types of cases Attorney General Letitia James pursued: half of all of New York’s False Claims Act cases were related to tax frauds.

Many state False Claims Acts, including the federal False Claims Act, do not allow tax related cases, despite the prevalence of tax fraud throughout the country. Incidentally, New York’s largest settlement, $105 million, was a tax related case.

The Prevalence of Healthcare Fraud

The next states with the highest value settlements were Illinois, Massachusetts, and Connecticut. Illinois and Connecticut’s cases focused on the healthcare industry, a reality likely necessitated by the increased opportunities for fraud during the Covid-19 pandemic. Massachusetts, in contrast, dealt with a wide variety of cases, from healthcare and unfulfilled state contracts to unemployment and infrastructure actions.

Across all eleven states that had successful False Claims Act settlements— California, Delaware, Illinois, Louisiana, Maryland, Connecticut, Massachusetts, Michigan, New York, New Jersey and Tennessee— nearly all cases were related to the healthcare industry, and Medicaid related fraud in particular. The highest value state False Claims Act settlement within the healthcare industry was achieved by Illinois, that settled a case for more than $56 million against the largest Medicaid managed care organization in the United States.

State FCA Statutes Permit States To Recover Funds Wrongfully Obtained by Fraud Against The State

State False Claims Act laws permit states to pursue all types of frauds, including those related to any state contract. New Jersey had the most recent state False Claims Act settlement, involving a private bus company that ripped off the State’s public transportation system by charging for rides that never occurred, and overbilling for hours worked and miles driven. Academy Bus paid New Jersey $20.5 million to settle the State’s claims and agreed to permit independent monitoring of its operations.

States like these that adopt and fund their own False Claims Acts recover taxpayer funds that are wrongfully taken on a regular basis.

Written by Fabiha Khan of Taxpayers Against Fraud

[1] The numbers in this post are the closest estimates TAF could achieve by reviewing press releases on state Attorney Generals websites.